- Where does trading take place?

- Tokyo session

- London session

- New York session

- Different currency pairs are more liquid during different sessions

- Trade smaller currencies in their regional time zones

- Trading during the day

- Trading during the week

You might be surprised that I’m writing an article on “When can you trade forex”? After all, I already said that you can trade anytime and anywhere. The market starts trading at 8 AM on Monday in New Zealand and keeps going until Friday afternoon in San Francisco.

That’s true as far as it goes, but that doesn’t mean trading is the same during all that time. There are ups and downs during the day. Because even if trading takes place electronically, there’s usually a person involved somewhere along the line. And people get up, go to work, do their job and then go home and go to sleep. Trading volumes tend to fluctuate with this rhythm.

Where does trading take place?

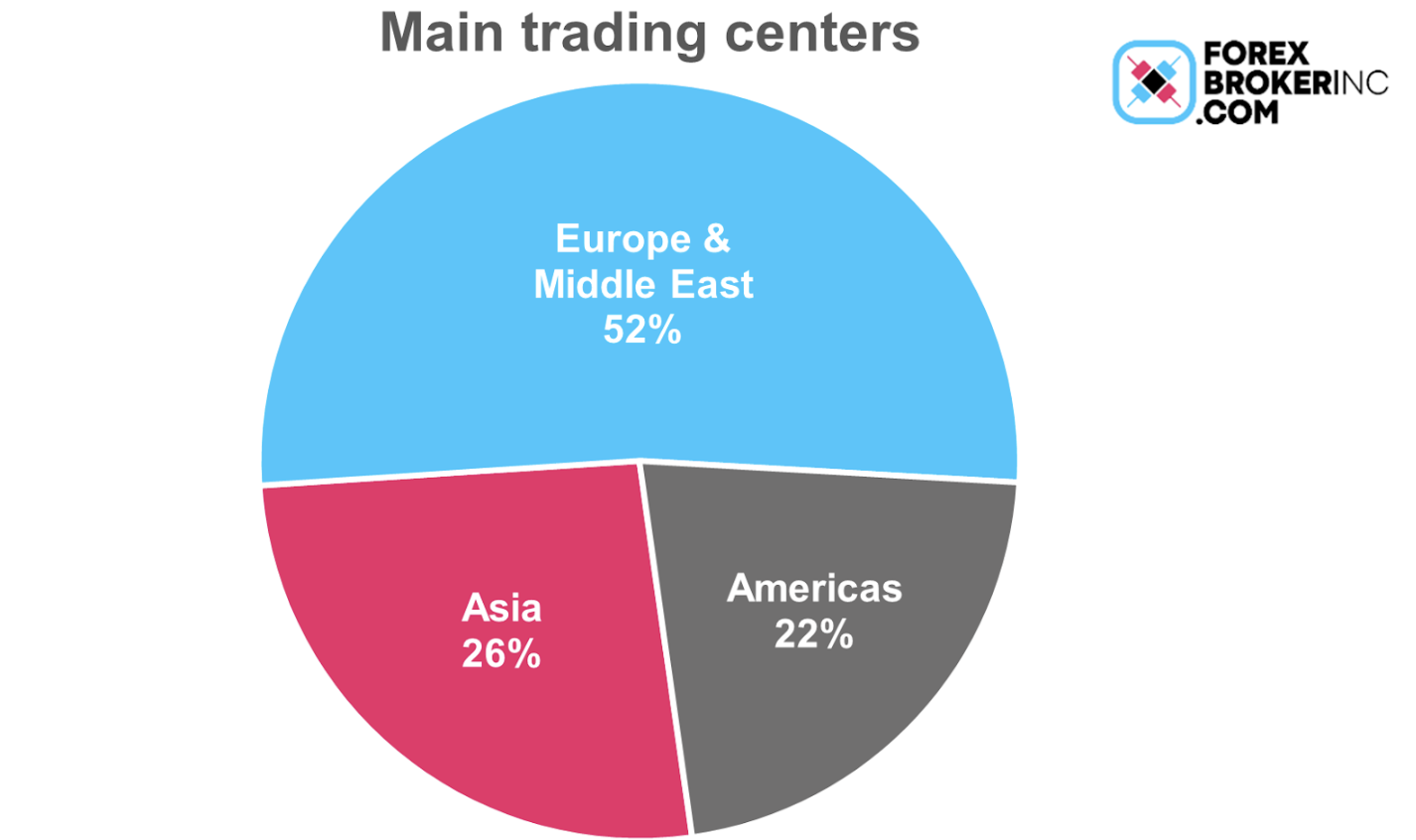

As you can see from this graph, about half the trading takes place in Europe, with Asia and the Americas splitting the rest pretty evenly.

The table shows the major FX trading centers in the world and their market share. As you can see, Britain and the US – or to be specific, London, New York, and Chicago – account for over half the world’s FX trading. After that, it’s Japan and Southeast Asia, represented by Singapore and Hong Kong. Those six cities alone account for 77% of all the world’s FX trading. Then it falls off rapidly.

So the most active times for trading are when European trading – or more precisely, London trading -- overlaps with business in other centers. That would be the end of trading in Asia, when European trading is just starting, and the beginning of trading in the US, when Europe is still open. Those are the most active times.

Tokyo session

The Asian trading session is referred to as the Tokyo session, even though as you can see, Tokyo isn’t the biggest FX trading center in the region any more. But volume in Singapore and Hong Kong is spread throughout a number of regional currencies, while Tokyo focuses on the major currencies. Japan is still considered the dominant market for FX in the region, although the rapid economic growth in Southeast Asia and the internationalization of the Chinese yuan has spurred the development of that part of the world as a trading center.

London session

The European session is referred to as the London trading session, because as you can see, trading during the European day overwhelmingly takes place in London. This is partially historical – the UK was the dominant economic power in the 19th century and sterling was the major reserve currency. While the US and the dollar have since taken over, London retained its place as the major currency trading hub because of its location, straddling the time zones of both Asia and the US. Surprisingly, the advent of the Euro actually helped to solidify London’s dominant position because trading in other European centers declined – Frankfurt was no longer dominant in trading the Deutsche Mark and Paris was no longer the center for French Franc trading.

New York session

The New York session lasts until around 5 PM New York time, but in fact activity slows down once London traders go home around 5 PM London time, which is about 10 AM New York time.

While most of the big banks are located in or around New York City, there’s also active currency trading in Chicago on the Chicago Mercantile Exchange (CME), known as the Merc. It’s the largest options and futures exchange in the world. But since 90% of their trading is done electronically, it’s hard to say precisely where it’s happening, and moreover, the electronic market operates around the clock.

There is some FX trading on the West Coast, at banks in Los Angeles or San Francisco, but traders there often work New York hours. I remember a business trip I had to San Francisco once – I had to be in the office by 5 AM, which is 8 AM in New York, and everyone went home at 2 PM, or 5 PM New York time. (I had plenty of time to go to the dentist and have an emergency root canal that day!)

In any event, 5 PM in New York is 7 AM in Tokyo and 8 AM in Melbourne, so as New York traders head home, they pass their books over to their colleagues in Asia and the Pacific and trading continues almost seamlessly. Not entirely though; trading in New York slows down before the close, while trading in Asia may take some time to get going, and trading on the CME stops entirely between 5 PM and 6 PM New York time. As a result, this period sees the thinnest FX trading (i.e., the lowest level of professional activity) of the day, making it a particularly dangerous time for traders. There have been several “flash events” during this period when currencies showed extraordinary movements that reversed in minutes. For example, on 7 October 2016, GBP plunged almost 9% vs USD before recovering much of its losses within minutes. The reverse happened with JPY on 3 January 2019, when the currency suddenly appreciated against the USD and a number of other currencies before quickly retracing much of the move. Both events seem to be connected to trading on the CME (in the case of GBP, trading on the CME was halted due to a large order, while in the case of the JPY, the event took place during the one hour that trading on the CME was down).

Different currency pairs are more active during different sessions

Although you can usually get a quote in all of the major currencies at any time of day, some times are better than others for trading them. For example, the yen is likely to be most actively traded and most volatile during the Tokyo session, because that’s what domestic Japanese investors focus on. That’s when Japanese institutions will be in the market buying overseas assets or hedging their existing positions. Japan’s economic indicators come out during that time too, of course.

The London session would see the most activity in EUR and GBP, for the same reason.

Of course, the dollar would be equally active in all these sessions, because most of these currencies would be traded against the dollar.

Trade smaller currencies in their regional time zones

If the time of day affects activity in the major currencies, it has an even stronger effect on activity in the smaller, less frequently traded currencies. The less active currencies are easiest to trade when their home country is open for business and harder to trade outside of that time.

For example, it might be hard to get a good quote in the CAD during the Asian trading day. How many people in Asia want or need CAD, or are following the Canadian economy? You’d be better off waiting until Toronto opens for business and the people who are most interested in Canada – that is, the Canadians themselves – get into work. . Similarly, trading the NOK or CHF would be easiest during European business hours, while AUD and NZD or certainly CNH would probably be best done during Asian time.

“Active” = deeper market and bigger movements

As I mentioned, the market is most active when more people are trading, and particularly when the traders of that currency’s home country are trading. “Active” usually means two things. One, it means that there are more market participants, so the market can absorb bigger trades without having unusually big moves. That’s called “liquidity,” because it refers to how easy it is to liquidate a position without moving the price. That’s not a big issue for most retail traders as your trades aren’t likely to be in the millions of dollars. Nonetheless you might find that spreads are narrower when the currency is most active and therefore it’s the least expensive time to get in or out of your position.

On the other hand, an active market also means that there are more people pushing and pulling on the price and more people taking big positions, so the price often tends to be more volatile. And that is indeed the way it is. Prices usually move the most during the London session, then the US session – maybe because it overlaps with the European session for a few hours. The Asia session tends to be less volatile for three of the four major currencies, the yen of course being the exception.

Trading during the day

You should watch out for various road bumps that occur during the day. For example, most countries announce their economic indicators at the beginning of their trading session, so markets can get volatile around then. On the other hand, markets tend to thin out during lunch as traders, salespeople and clients take a break away from their desks. That could mean they’re less volatile as there are fewer people trading, but sometimes it could also mean they’re more volatile as the market lacks depth to absorb a big trade.

Also, people coming in during the morning often decide to join in on a trend, so a move that started in one time zone may get a boost when trading starts in the next zone. Or they could decide it’s gone too far and try to push it back. Also, as traders start to pack up and go home for the day, they often close out their positions and the market sometimes reverses direction toward the end of a trading session.

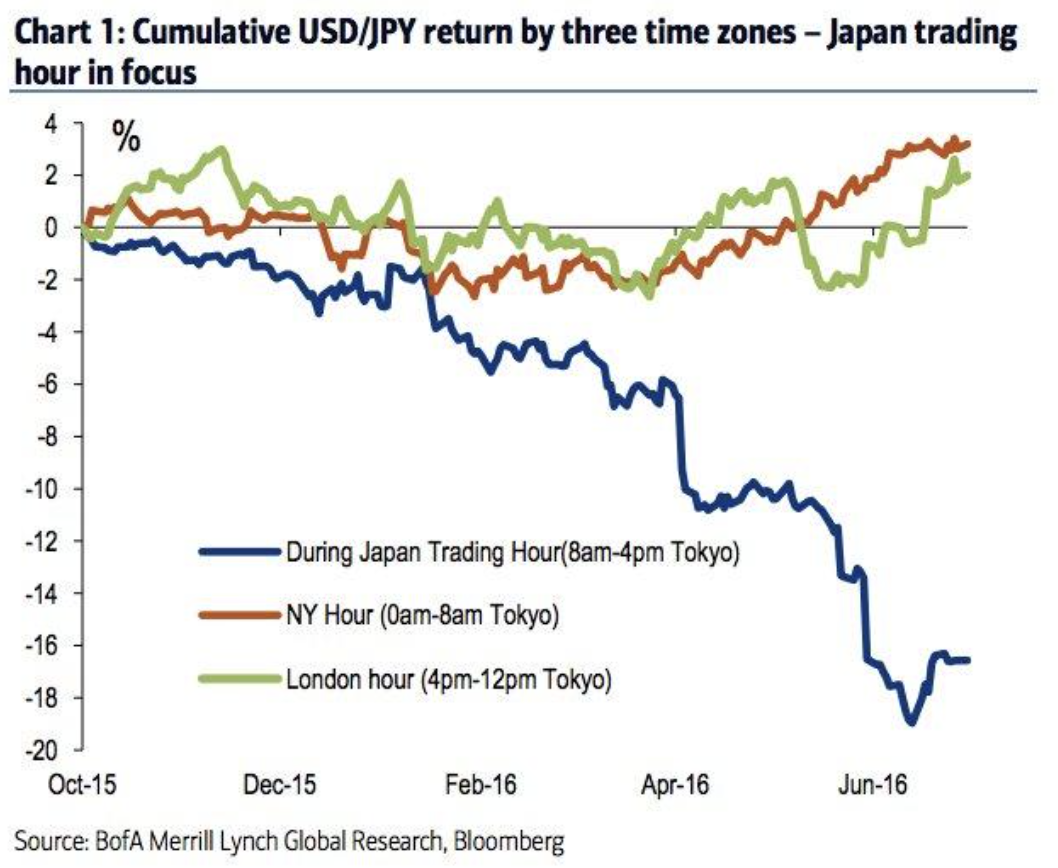

Finally, investors in one time zone often have a different view of the market than investors in another time zone. For example, the Japanese often have a different view of their economy and currency than investors elsewhere, and the yen can trend differently during Tokyo trading time than it does other times. This graph from Bank of America/Merrill Lynch shows the cumulative movement in USD/JPY during the three trading sessions from October 2015 to June 2016. As you can see, while market participants outside of Japan were fairly neutral on the pair, those in Japan were distinctly positive on the yen and negative on the dollar, which caused USD/JPY to decline (yen to appreciate) during that time zone. That kind of difference in sentiment can exist as different people focus on different topics, read different newspapers, and listen to different experts.

The currency fixes

Many investors need to know “what was the forex rate on such-and-such a date”? Mutual funds and exchange-traded funds that have holdings in different currencies need benchmark rates to value their different holdings. Some derivative contracts need to be settled in different currencies. The taxman wants to know what “the currency rate” was on a certain day. As a result, benchmark exchange rates, commonly called “fixings,” are calculated and published several times a day. The best known and most widely used one is the one calculated at 4 PM London time by WM/Refinitiv, which is often referred to as the “London closing rate” (even though the forex market never really closes during the week).

Since these currencies are used to value portfolios, many asset managers routinely seek to trade at these rates so that their actual portfolio results will be in line with the theoretical results. The market therefore often experiences a big spike in activity around that time of day. It’s especially so on the last day of the month, when many asset managers rebalance their portfolios. For example, if they’re supposed to keep 50% of their assets in US stocks and 50% in Japanese stocks and the Japanese market has gone up by more than the US market during the month, they’ll have to sell some Japanese stocks and buy US stocks to keep their agreed-upon balance. That will result in selling of JPY and buying of USD (i.e., selling of USD/JPY).

There are other well-known fixes in the market, such as the Tokyo morning fix calculated by various Japanese banks at 9:55 AM local time (00:55 GMT).

These fixes attracted little attention outside of the industry before 2013, when traders at some major banks were accused of manipulating the rates. After all, if you know that a lot of your clients are going to want to, say, buy euros at the benchmark rate, you can buy a lot ahead of time, collaborate with your pals in other banks to push the rate up at the last minute, and then offload your inventory to your clients at the higher price. Substantial fines were imposed on major banks in several countries and the fixing process was reformed (e.g., the rates are now taken over a window of five minutes rather than one minute before – it’s easy to goose the market higher for one minute but hard to keep it there for five). Nonetheless, some people still warn of unusual volatility around fixing time in London, especially at month ends.

Trading during the week

Finally, market activity tends to vary during the week. The market tends to be least volatile on Mondays and Fridays and more volatile on Tuesday, Wednesday and Thursday. That’s probably because people are getting ready for the week on Monday, there are often internal meetings, and people are absorbing the news from the weekend. Friday of course trading slows down as people often pack up early and leave for the weekend, and don’t even think of trading Friday afternoon New York time. Sometimes if there’s been a trend during the week it might reverse on Friday afternoon as investors holding profits tend to take some of those profits and cut or close their positions before going home for the weekend.

The exception of course is if there’s some big news that comes out over the weekend. In that case, the markets can open Monday in New Zealand and Australia with a gap from Friday’s close and Monday morning trading can be quite volatile.

There is some trading in a few Middle Eastern centers on Sunday, but I don’t think it has a big impact on trading.

SUMMARY

Trading is broken down into three sessions: the Tokyo session, the London session, and the New York session. Trading is most active during those periods when two trading regions are open at the same time. Currencies tend to trade more actively when their home market is open. Markets are also most active during the middle of the week; Mondays and Fridays tend to be a bit quieter.