- The three major types of players: the big banks, other financial institutions, and non-financial customers

- The big banks & security companies

- Non-financial customers

- “Other financial institutions” (hedge funds & you)

- Retail: only 6% of the market

Trading is of course the buying and selling of assets. For every buyer there has to be a seller and for every seller there has to be a buyer, otherwise you can’t trade. So when you’re trading forex, who are you trading against? When you sell, who’s the buyer, and when you buy, who’s the seller?

In your case, as a retail traders, you’re probably going to be trading against your brokerage firm. Many brokers operate what’s called dealing desks. They

In our last series of videos, I described the various advantages of trading FX for the retail investors. Now I’d like to discuss who the other participants in the market are.

We know pretty well who the other participants are, because the Bank for International Settlements, or BIS, does some research on this question every three years. (If you haven’t heard of the BIS, don’t worry – it’s not very well known.) And here’s what they’ve found.

The three major types of players: the big banks, other financial institutions, and non-financial customers

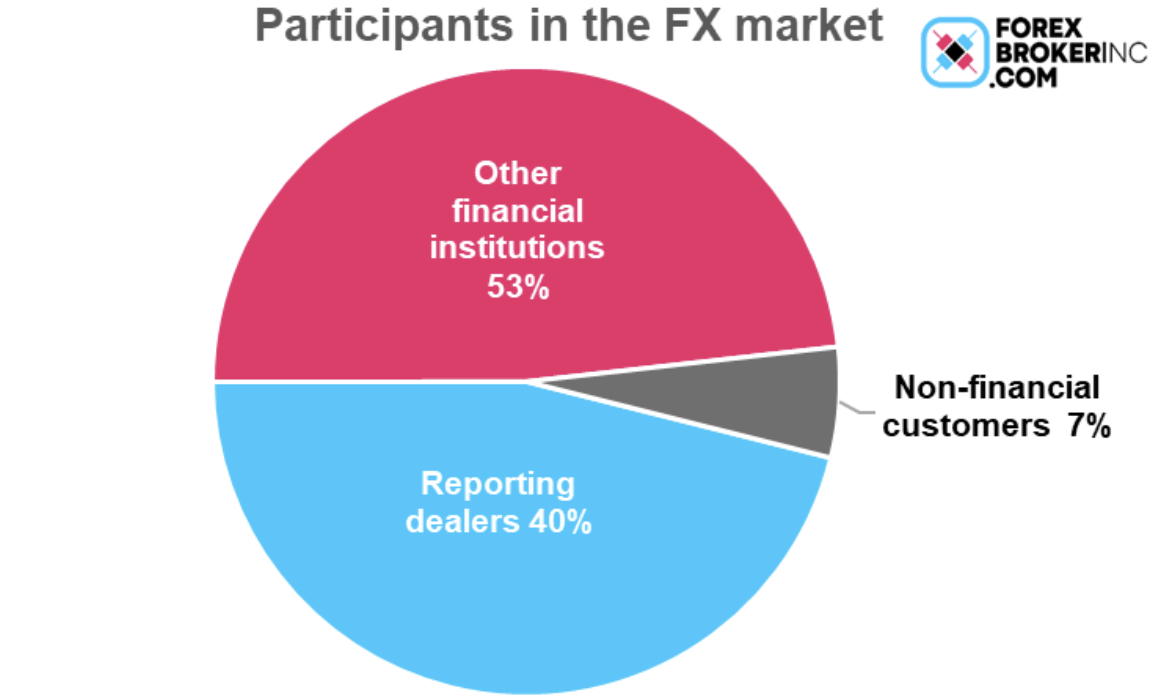

The BIS divides the FX market into three major groups: the big banks & security companies – called “reporting dealers” in this graph -- other financial institutions, and non-financial customers. The big banks and security companies are 42% of the market, other financial institutions are a little over half the market, and non-financial customers are a pretty small part – 7%.

The big banks & security companies

The big players – the “reporting dealers” – do 42% of the transactions, or a little less than half. These are the big banks and securities houses that stand at the center of the FX market. They trade with everyone else, offering to deal in any kind of circumstances, even when the market gets wild. They’re called “reporting dealers” because they’re big enough to report their transactions directly to the BIS. A lot of their business will be for customers, but a lot will be for their own trading accounts, too. They’re both market-makers and speculators at the same time.

Non-financial customers

Non-financial customers are the ones who used to be the focus of the market. These are the companies that import or export goods and need to buy foreign exchange to make the transactions. For example, Toyota gets dollars when it sells its cars in the US, but it has to convert these dollars back into yen to pay its workers in Japan. Wal-Mart needs to buy Chinese yuan in order to buy goods from China. And when a British company buys a company in France, it needs to pay for the acquisition in euros. Some government agencies are included here too. As you can see, these folks nowadays account for relatively little of the market. This is why data on international trade isn’t as important for the FX market as it used to be.

“Other financial institutions” (hedge funds & you)

Finally, there’s the “other financial institutions,” which account for about half of the FX business. And here’s where it gets interesting.

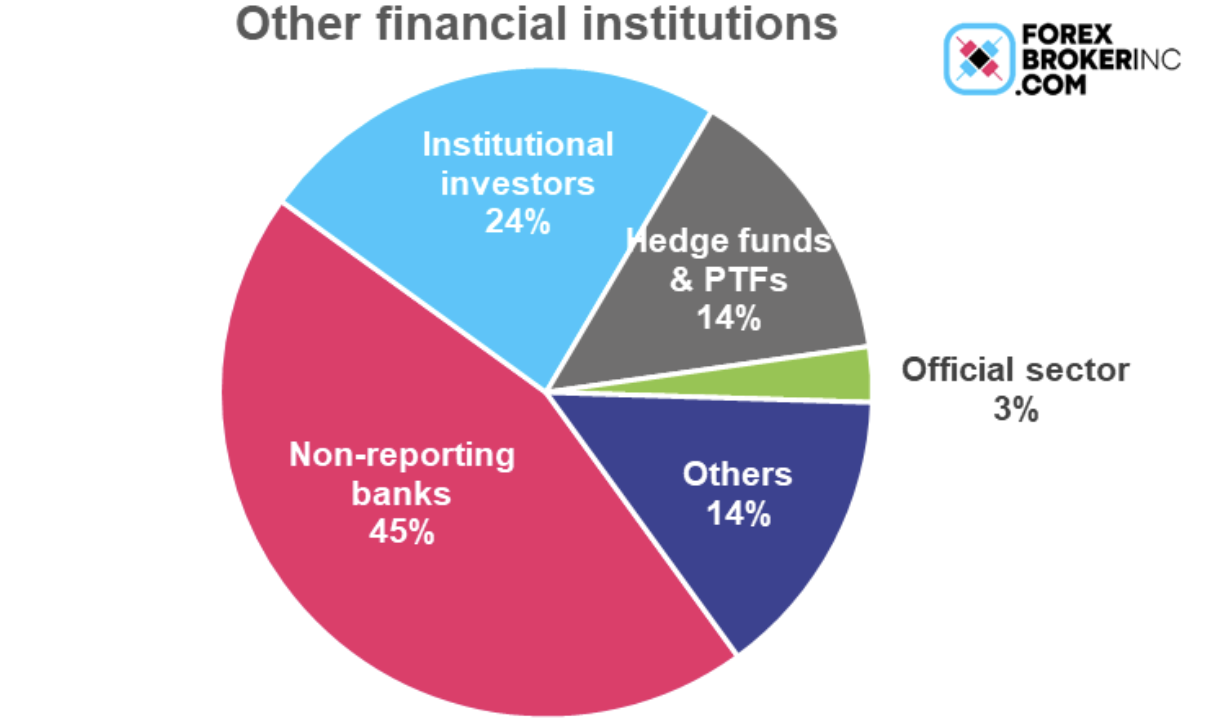

The largest part of this group is “non-reporting banks.” These are smaller or regional commercial banks or securities firms that don’t report their transactions directly to the BIS. They may be smaller, but they still do a lot of business -- about $1.1tn a day. That’s about half of what the “reporting dealers,” the big banks on the previous graph, do. Put these two together and you get about 2/3rds of the total turnover of the market. So really, banks account for about two-thirds of the total market turnover. As I said, this isn’t all customer business – a lot of it will be the banks themselves trying to make some money by speculating on the market.

After that comes “institutional investors.” They do close to $800bn of business a day. That’s about 16% of the total market. These are what are commonly referred to as “real money investors.” They include investors such as mutual funds, pension funds, and insurance companies. When they want to buy a foreign stock or bond, they need to make an FX transaction so that they can pay for it in another currency. Or often they want to hedge their foreign investments. And sometimes they’re probably just speculating.

Next comes the real, serious speculators: the hedge funds and proprietary trading firms, or PTFs. These folks are also investing in stocks and bonds all over the world, but with a lot more leverage and a lot higher turnover. This group also includes funds that only trade currencies, so of course their activities are very important for the market. This includes a kind of hedge fund known as “commodity trading advisors,” which sometimes trade commodities like corn and oil but often trade FX.

Finally, these proprietary trading firms include the newest and scariest participants in the FX market: high-frequency trading firms. These are computer-driven investors that use special high-speed computers and high-speed transmission lines to make thousands of trades each second. In theory, a good high-frequency trading firm could trade $30bn in the time it takes for you to blink! These are sharks waiting to eat the minnows.

The official sector includes central banks, sovereign wealth funds, and various international financial institutions and agencies, such as the BIS itself. They’re normally a small part of the market, but they can be extremely influential if they want to be. If a central bank decides that they want their currency to go one way or another, they may have the firepower to make it happen. But more of that at another time.

Finally, there’s the “other” group. That’s everyone else, including you, the retail investor.

Retail: only 6% of the market

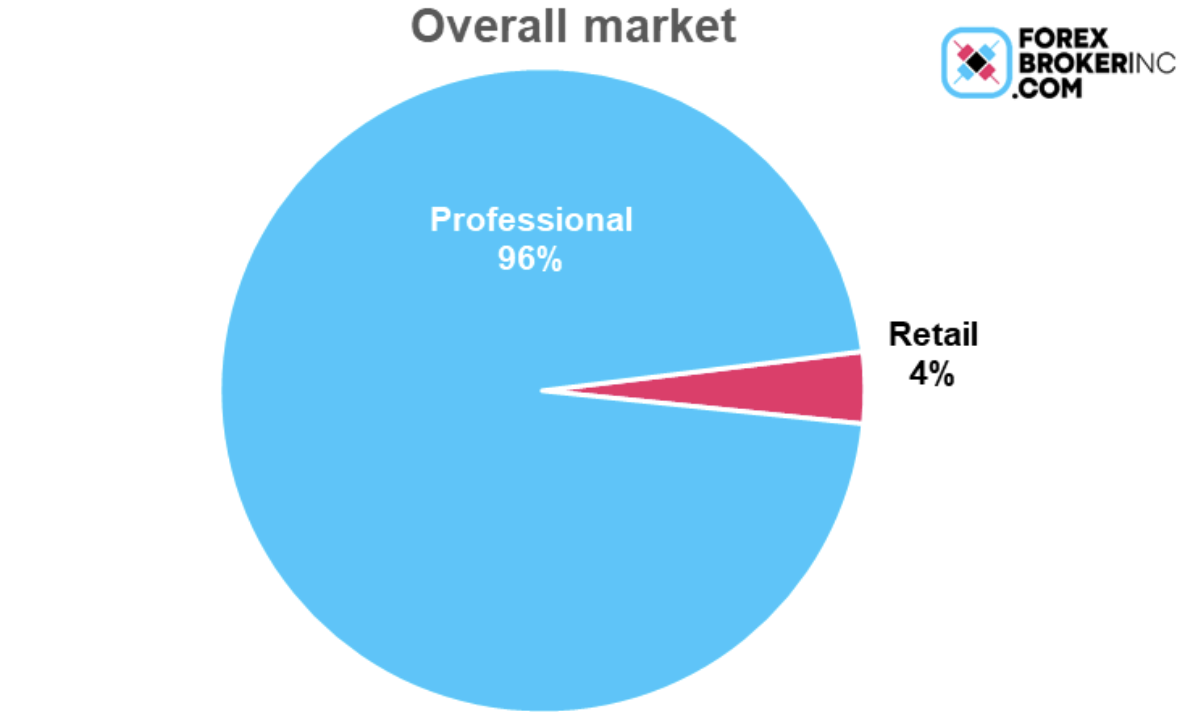

Retail transactions averaged $283bn a day. That’s a huge amount of money. It’s about 3/4s as much as is done on all the world’s stock markets every day. But it’s still only 6% of the total FX market turnover. The overwhelming part of the market is professional. So you should know who you’re playing against: a lot of professionals.

SUMMARY

In short, the FX market is made up of three major groups. The big banks and security companies that actually make a market in FX are a little less than half the market. Other financial institutions are about half – this includes smaller banks, hedge funds, and so-called “real money investors,” such as pension funds and insurance companies. Finally there are importers and exporters, but they’re a pretty small part of the market. Retail – that’s you -- accounts for only 6% of total trading. So keep that in mind: when you trade FX, you’re trading against some pretty smart players.